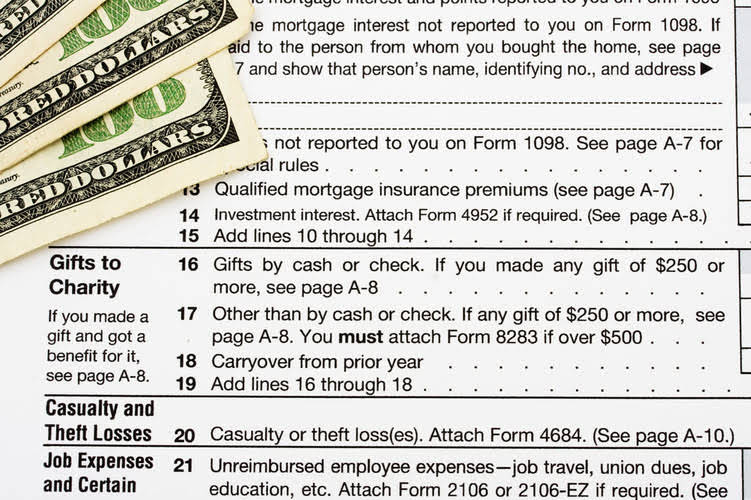

Each month of historical bookkeeping is peer-reviewed to ensure total accuracy. When you need to catch up on your bookkeeping, tracking your income and expenses can be difficult. From office catch up bookkeeping supplies to professional services, tax deductions can shave off a significant amount from your tax bill. Hunt for discrepancies between your statements and your internal records.

Quickbooks & Xero

Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. The needs of your business now may not be the needs of your business later. That’s why we’ve created affordable plans tailored to meet you where you are right now. Find the right one and start working with your dedicated team today.

What is a Bookkeeper and Why Do You Need One?

Any inconsistency can turn into a red flag, making them wonder what else is wrong with your business. You can connect with a licensed CPA or EA who can file your business tax returns. Let a professional sort your books for you and develop a bookkeeping system that will serve you well now and for the future. Xendoo can quickly and accurately catch you up, setting you up for success. In the worst-case scenario, your outdated books can leave you in the dark when it comes to your cash flow, jeopardizing your ability to cover expenses, payroll, and more.

Catch Up Bookkeeping for Small Business. Don’t get behind on your books.

- Continuously invest in training and education for your finance team to stay updated on accounting principles, regulations, and best practices.

- That’s why we send a financial package for each year of catch up.

- If you suggested catch up bookkeeping is something about catching up with your bookkeeping, you’re right.

- For instance, if your records are incomplete, you will need a more skilled bookkeeper to figure out where the trail went cold and how to put together the missing pieces.

- Like the Eastern brook trout, Rainbow trout will go after nearly any bait or lure, but MassWildlife most recommends using Berkley Fishing’s PowerBait, specifically the marshmallow variety.

- Say you’re transitioning from an Excel spreadsheet to a software like QuickBooks.

- However, sometimes things get busy, and bookkeeping gets pushed to the bottom of the to-do list.

Being able to quickly and easily review the status of your finances is crucial to short and long-term success for any business owner. When you know the health of your finances, you can make quicker decisions concerning everything from who to hire next to what marketing strategy recently worked best. Maintain accurate and consistent books for assigned customers, including recording payments, expenses, and adjustments weekly and performing monthly bank, credit card, and Balance Sheet reconciliations. Provide higher-level accounting guidance to the Xendoo Accounting team.

Ready to give our services a try?

The catch-up process involves entering all the transactions into an accounting system and reviewing and reconciling them. The goal is to provide accurate financial statements reflecting the true state of business finances, which is a key requirement, especially as the tax season rolls https://www.bookstime.com/ around. When you work with Ignite Spot Accounting, you’ll get bookkeepers certified in a variety of popular programs, such as QuickBooks and TSheets. If you choose its chief financial officer (CFO) services, your CFO will be a certified public accountant (CPA) at a minimum.

Virtual CFO Services

I can say the same about stakeholders who could back out due to sloppy financial records. Perhaps your current accounting software doesn’t offer the type of reporting you’re looking for. Maybe the current software cannot accommodate the size of your growing business and you wish to upgrade to a more sophisticated suite. You want to ensure the complete and accurate transfer and labeling of all your data. Before migrating, you may need help to make sure all your records are up to date in the current software. Each tax year taxpayer must complete the current tax year Tax Organizer and sign and date to assert any current tax filing status changes that would be impacted by the tax law TCJA of 2017.

- If you’d prefer to have someone else process that backlog of bookkeeping for you, get in touch.

- First, you’ll need to find all the receipts, invoices, and other important paperwork related to your business expenditure.

- If you need to separate your business and personal expenses, the sooner you do it, the better.

- We can fully wipe your data, too—at the end of the day, it’s your info and your call.

- For instance, during busy periods such as peak seasons or significant projects, entrepreneurs may defer bookkeeping responsibilities, leading to a backlog of financial transactions and documentation.

LanceDB, which counts Midjourney as a customer, is building databases for multimodal AI

By being aware of these common bookkeeping errors and implementing best practices, you can maintain accurate financial records and make more informed financial decisions for your business. Think of software like QuickBooks, Xero, or FreshBooks as your personal assistants for managing your bookkeeping paperwork, including tax preparation. They track income and expenses and can generate financial statements. Additionally, if you started a new vertical in your business, you may want to track their profitability separately; then, you also need to realign your numbers to reflect the new reality. Ensuring that all financial records are current and complete is crucial as part of the clean-up bookkeeping process.

Running a business can be challenging, with tasks like bookkeeping often sidelined due to their tedious and time-consuming nature. Catch up bookkeeping exists precisely for these scenarios, offering help to businesses grappling with overdue financial records. Your bookkeeper reconciles your accounts, categorizes your transactions, and produces your financial statements. They also make adjustments to your books to ensure they’re accurate and tax-compliant. Occasionally your bookkeeper might need your input on things like categorizing a transaction properly, but we try our best to make bookkeeping as hands-off as possible for you.

The Role Of An Accountant: A Guide To Today’s Accountant’s Roles, Duties, And Responsibilities